Review all the options in Account and Settings in QuickBooks Online to make sure the features your client needs are turned on—and configured correctly. Turn off any features the client doesn’t need.

To do this, go to the Gear icon on the top right and select Account and Settings.

Best practice is to check everything here. Go through each tab on the left and make sure that the associated features and settings are configured as required.

Company

Things to review and add/update in the Company section include:

- Add any company information that didn’t transfer over to QuickBooks Online, such as the company logo (which doesn’t convert from QuickBooks Desktop)

- Select the appropriate tax form

- Update the customer-facing email and phone number, if required

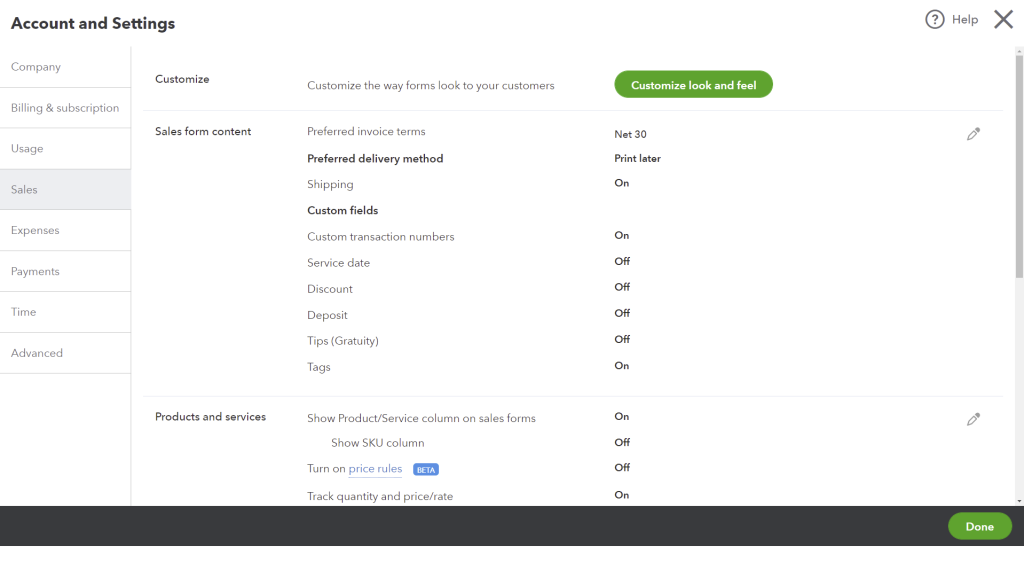

Sales

To confirm what other features are required in the Sales section, ask your client:

- Are the preferred invoice terms and delivery method correct?

- Do they want to give discounts and accept deposits?

- Do they want to use custom transaction numbers, tags, and progress invoicing?

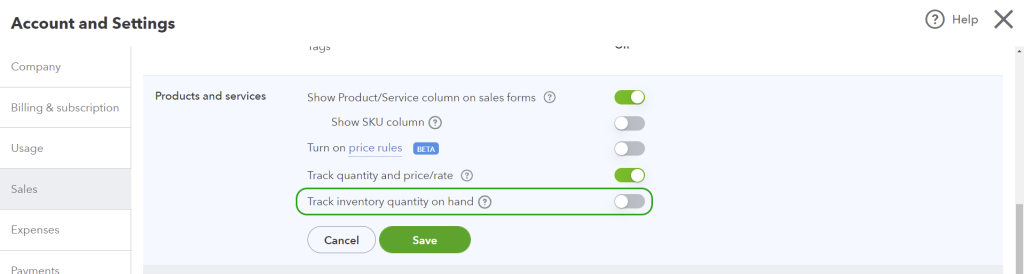

If you converted inventory, Track inventory quantity on hand should be set to ON. Otherwise, it should be OFF.

Also in this section, ask your client:

- Whether they charge late fees

- If they want to use progress invoicing

- What online delivery options they want for sales forms and invoices

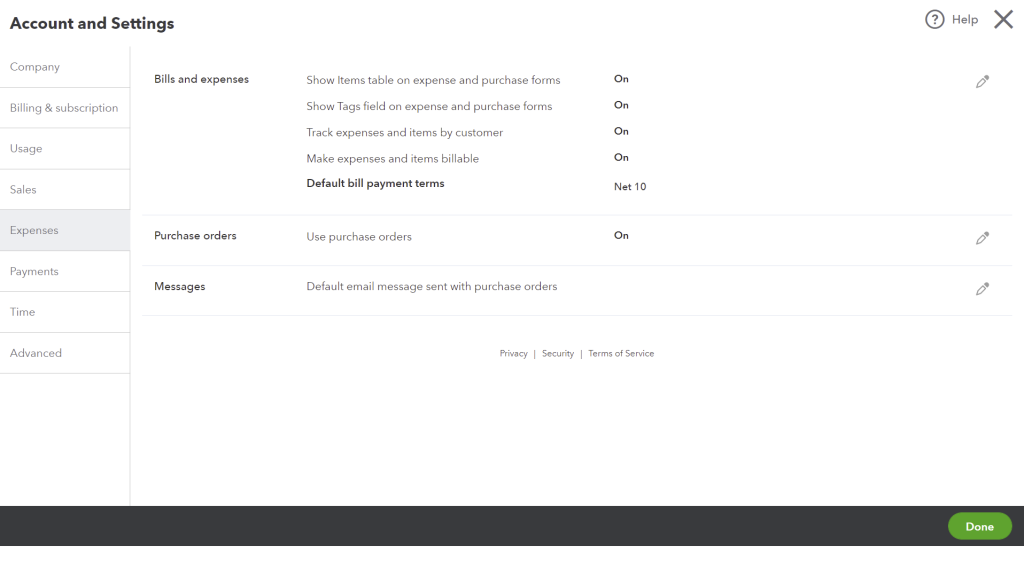

Expenses

Work with your client to decide whether to turn on/off the features in the Expenses section:

- Show Items table

- Show Tags field

- Track expense and items by customer

- Make expenses and items billable

- Purchase orders